In today’s fast-paced, technology credit union driven world, credit unions are under increasing pressure to modernize and adapt to the evolving expectations of their members. No longer just a place to store savings or apply for loans, credit unions now serve as hubs for financial services that need to meet the demands of a digital-first, mobile-savvy population. With fintech innovations, mobile apps, blockchain, artificial intelligence, and other digital technologies, credit unions can offer enhanced, personalized services that not only improve operational efficiency but also place members at the heart of their offerings.

This article explores how credit unions are embracing digital technology to drive member-centric growth, enhancing member experience, increasing operational efficiency, and fostering stronger member relationships. The integration of digital technology allows credit unions to maintain their unique community-driven values while ensuring they remain competitive in the rapidly evolving financial sector.

Key Takeaways

- Credit unions must embrace digital transformation to stay competitive and offer personalized, convenient, and secure services.

- Mobile banking, AI, cloud computing, and blockchain are key technologies driving member-centric growth in credit unions.

- Digital transformation improves operational efficiency, reduces costs, and enhances the overall member experience.

- By leveraging data analytics, credit unions can offer tailored financial products, making them more relevant and appealing to members.

The Importance of Digital Technology Credit Union

Historically, credit unions have been known for their member-focused approach, operating on a cooperative model where members are both customers and stakeholders. Their commitment to offering personalized financial services with lower fees and better interest rates has built strong member loyalty. However, as the financial landscape has become more competitive, credit unions face increasing pressure to innovate in order to meet the expectations of a digital-first world.

Digital transformation, the integration of digital technologies into all aspects of business operations, has become crucial for credit unions to stay relevant and effectively serve their members. Gone are the days of only offering in-branch services; today’s credit union members demand seamless, accessible, and secure digital services that they can use anytime, anywhere. For credit unions to maintain their competitive edge and grow their membership, embracing digital technology has become a strategic necessity.

Key Areas Where Technology Is Transforming Credit Unions

Mobile Banking and App Integration

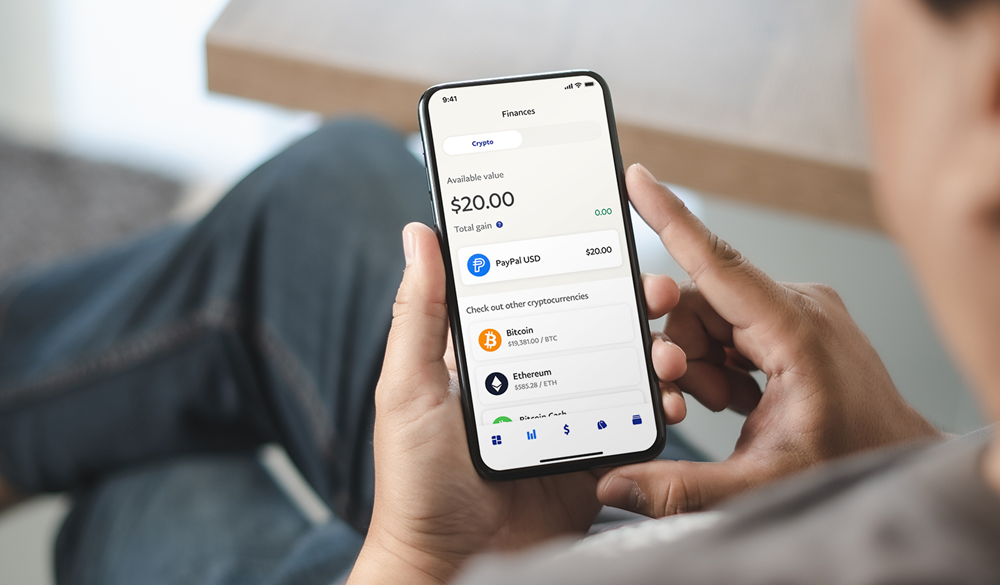

Mobile banking is arguably one of the most significant technological advancements in the financial services industry. With the rise of smartphones and apps, credit union members now expect to be able to perform a wide range of banking activities on-the-go. Whether it’s checking account balances, transferring funds, or applying for loans, mobile banking provides an added layer of convenience that members have come to expect.

Credit unions are integrating mobile banking apps that allow members to manage their finances from their smartphones. These apps often include features like mobile check deposit, fund transfers, account alerts, and budgeting tools. The ability to provide secure, intuitive mobile banking solutions not only enhances the member experience but also fosters loyalty, as members appreciate the ease and accessibility that comes with mobile banking.

Moreover, mobile apps give credit unions the opportunity to offer personalized features to members, such as transaction tracking, spending categorization, and financial wellness tips. By leveraging data analytics, credit unions can offer customized financial products, notifications, and advice based on a member’s transaction history and financial behavior, thus creating a more member-centric approach.

Artificial Intelligence (AI) and Machine Learning

Artificial Intelligence and machine learning have found significant applications in the financial services industry, and credit unions are no exception. AI-powered tools can help credit unions provide better services by automating routine tasks, improving customer support, and offering personalized financial recommendations.

For example, AI-driven chatbots and virtual assistants can handle member inquiries 24/7, reducing the need for manual intervention and increasing member satisfaction. These tools can quickly respond to frequently asked questions, guide members through common banking tasks, and even assist with basic troubleshooting. By providing faster, more efficient customer service, AI helps free up staff time for more complex interactions and deepens the relationship between the credit union and its members.

Machine learning algorithms can also be used for credit scoring, loan underwriting, and fraud detection. By analyzing vast amounts of data, these systems can identify patterns that indicate potential risks, such as loan defaults or fraudulent activities, enabling credit unions to take proactive measures and mitigate risks before they become major problems.

Cloud Computing

Cloud computing has become one of the most important technologies for organizations of all sizes, including credit unions. By leveraging cloud-based platforms, credit unions can streamline their operations, reduce costs, and enhance security. Cloud computing allows credit unions to store data securely and access it remotely, ensuring that members’ financial information is always up-to-date and protected.

Cloud technology also facilitates seamless integration with other financial services, enabling credit unions to offer a more unified and comprehensive suite of services. For instance, members can use cloud-based platforms to access their financial portfolios, perform transactions, and access financial advice, all through a single integrated system. Additionally, the scalability of cloud services means credit unions can easily expand their offerings without incurring hefty costs for additional infrastructure.

The ability to update software and systems in real-time via the cloud also ensures that credit unions can respond quickly to regulatory changes, new security threats, or emerging technology trends. This agility allows credit unions to stay competitive in a dynamic financial market.

Blockchain and Digital Payments

Blockchain technology is making waves in the financial sector, and credit unions are beginning to explore its potential to improve the efficiency and transparency of transactions. Blockchain, which underpins cryptocurrencies like Bitcoin, is a distributed ledger technology that offers a secure, transparent, and tamper-resistant way to record transactions. For credit unions, blockchain can be used to streamline payment processing, reduce transaction fees, and increase the speed of cross-border transactions.

With the rise of digital payments, credit unions are integrating various forms of payment methods, including mobile wallets, contactless payments, and peer-to-peer (P2P) payment systems. These digital payment solutions make it easier for members to pay bills, transfer funds, and make purchases with just a few taps on their smartphones. By embracing digital payment technologies, credit unions can offer members a seamless and secure way to manage their financial transactions.

Moreover, the integration of blockchain can provide increased security for digital payments, offering enhanced privacy and reducing the risk of fraud. Blockchain’s decentralized nature also means that credit unions can offer faster settlements and more transparent tracking of funds, further enhancing the member experience.

Data Analytics and Personalization

Data is at the heart of the digital transformation in credit unions. With the vast amount of information available through digital channels, credit unions now have the ability to leverage data analytics to gain insights into their members’ needs, preferences, and behaviors. This allows credit unions to offer more personalized financial products and services that cater to the unique needs of each member.

By using predictive analytics, credit unions can anticipate when members are likely to need a loan or when they may be interested in refinancing a mortgage. Similarly, data analytics can help credit unions identify members who may benefit from financial literacy programs or those who are at risk of overdraft fees or late payments, allowing them to intervene proactively and offer tailored solutions.

Data-driven decision-making also extends to credit risk analysis. Credit unions can use machine learning algorithms to assess the creditworthiness of potential borrowers, factoring in a wider range of data points beyond traditional credit scores. This results in more accurate lending decisions and allows credit unions to serve a broader range of members, including those with limited credit histories.

Benefits of Digital Transformation for Credit Unions

Improved Member Experience

The ultimate goal of digital transformation in credit unions is to provide an improved member experience. Digital tools allow credit unions to offer convenient, fast, and personalized services that meet members where they are. By leveraging mobile apps, AI-driven support, and customized financial products, credit unions can enhance the accessibility and quality of their services, ultimately increasing member satisfaction and retention.

Increased Efficiency and Cost Savings

Automation and digital tools help credit unions streamline operations and reduce costs. Processes like loan underwriting, fraud detection, and customer service can be automated, freeing up staff to focus on more complex and value-added tasks. Cloud computing further reduces infrastructure costs by eliminating the need for expensive on-premise servers and hardware.

Strengthened Security and Compliance

Digital technologies also enhance security, a top priority for credit unions in today’s cyber risk environment. Advanced encryption, biometric authentication, and blockchain can help protect members’ data and transactions from fraud and cyberattacks. Moreover, digital systems can be updated more easily to ensure compliance with evolving regulations, ensuring that credit unions remain on the cutting edge of security and legal requirements.

Competitive Advantage

By embracing technology, credit unions can stay competitive in a crowded financial marketplace. As fintech companies continue to disrupt traditional banking models, credit unions must modernize their offerings to retain members and attract new ones. Digital technologies enable credit unions to provide innovative products and services that rival those offered by larger banks and fintech startups.

Also Read:

Conclusion

The digital transformation of credit unions is not just a trend—it is a necessity in today’s rapidly evolving financial landscape. By embracing digital technologies such as mobile banking, AI, blockchain, cloud computing, and data analytics, credit unions are not only improving operational efficiency but also enhancing the member experience. These innovations allow credit unions to offer personalized, secure, and convenient services that are essential to meeting the expectations of today’s tech-savvy members.

Incorporating these technologies enables credit unions to stay competitive, build stronger relationships with members, and position themselves for future growth. As the financial industry continues to evolve, the role of technology in shaping member-centric credit unions will only become more important, making it crucial for credit unions to continue embracing digital innovation.

FAQs

What is digital transformation in credit unions?

Digital transformation in credit unions involves integrating technology into all aspects of the organization, from mobile banking and AI-driven services to cloud computing and blockchain, with the goal of enhancing member experience and operational efficiency.

How does AI improve the services offered by credit unions?

AI enhances credit union services by automating tasks, improving customer support through chatbots, offering personalized recommendations, and analyzing data for better decision-making, such as credit risk analysis.

How secure is mobile banking for credit union members?

Mobile banking is highly secure with advanced encryption, multi-factor authentication, and biometric security measures. Credit unions also use secure servers and cloud computing to protect members’ data from cyber threats.

Can credit unions compete with large banks in the digital age?

Yes, credit unions can compete with large banks by leveraging technology to offer personalized services, improve customer experience, and reduce operational costs. Digital transformation enables credit unions to provide cutting-edge financial products and services that meet modern member needs.

How does blockchain benefit credit unions?

Blockchain offers credit unions secure, transparent, and efficient ways to process payments and record transactions. It reduces fraud, lowers transaction costs, and provides faster settlement times, which is especially valuable for cross-border payments.

What role does data analytics play in credit unions?

Data analytics helps credit unions understand members’ needs and preferences, allowing them to offer personalized financial products, identify at-risk members, and make more informed decisions about lending and risk management.

How do cloud services benefit credit unions?

Cloud services allow credit unions to store and access data securely while reducing the need for costly on-premise infrastructure. It also ensures scalability, flexibility, and real-time software updates, improving operational efficiency and security.

Tags: AIInBanking, BlockchainInBanking, CloudComputing, CoreBankingSystems, CreditUnionApps, CreditUnionAutomation, CreditUnionGrowth, CreditUnionInnovation, CreditUnionTech, Cybersecurity, DataAnalytics, DigitalBanking, DigitalIdentityManagement., DigitalLending, DigitalPayments, DigitalTransformation, DigitalWallets, FinancialInclusion, FinancialServices, FinancialTechnology, Fintech, FintechIntegration, MachineLearningInBanking, MemberExperience, MobileBanking, OnlineBanking, OpenBanking, PaymentProcessing, TechnologyInCreditUnions, TechSolutions, UserExperienceInBanking